Why Core+ and Why Now?

March 25, 2024

The Road to Now

Core+ strategies have long been utilized by investors to not only diversify their risk, but augment returns via higher yields. During the QE era, the “plus” portion of many core investor portfolios was one of the few avenues through which investors could capture meaningful yield as developed market (DM) rates hovered around zero and Investment Grade (IG) spreads had compressed to all-time tights. Record-breaking inflows into both passive and active emerging market (EM) and high yield (HY) strategies reflected an insatiable demand for yield. EM and HY spreads compressed accordingly, and riskier nations and corporations were more than happy to issue plenty of debt at much cheaper levels to meet demand. Over time, the “plus” became less and less compelling; yields collapsed and downside risks were not being properly priced. All the while, the taps were still open and the market was drunk on the sweet flow of easy monetary policy.

Like all parties, eventually the music stops, and the lights come on. A global pandemic followed by an unprecedented level of stimulus and loose monetary policy, coupled with supply chain disruptions, pent-up demand, and a juiced-up consumer, led to an unsurprising negative consequence: inflation on a global scale. The “plus” crowd would not enjoy the harsh light and the sound of the record scratching as the music came to an abrupt halt. It was time to sober up.

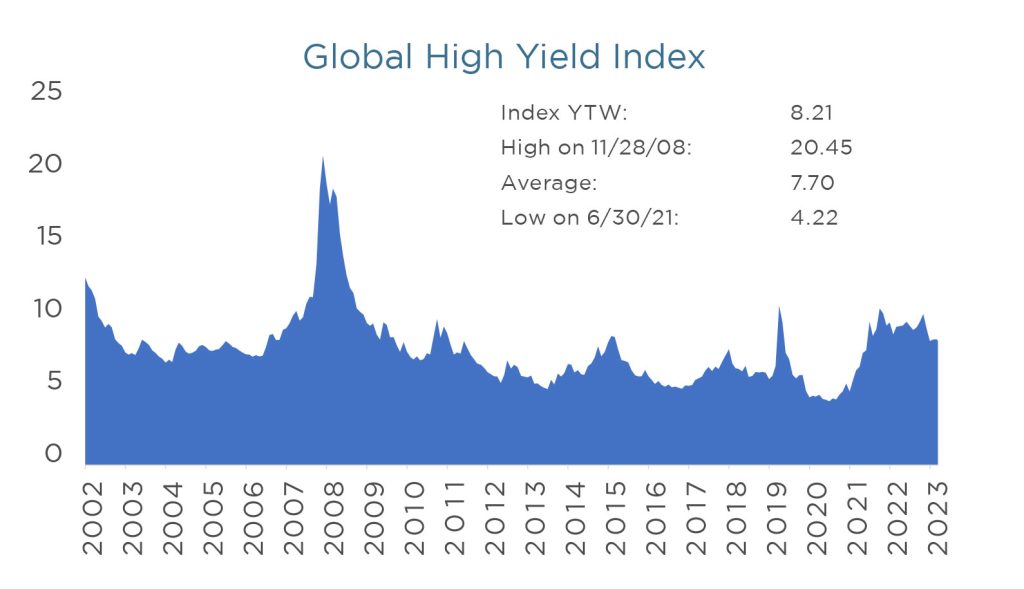

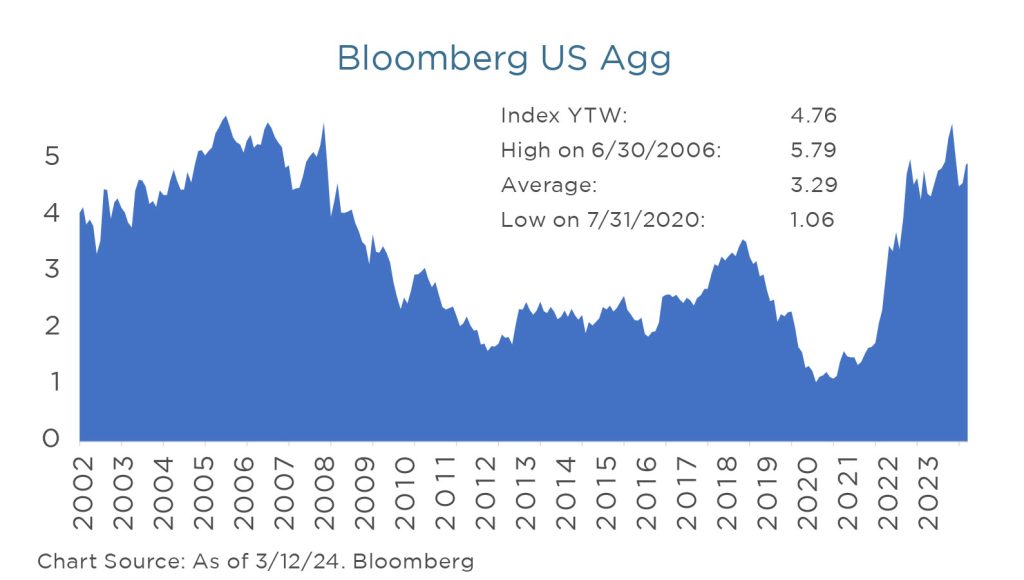

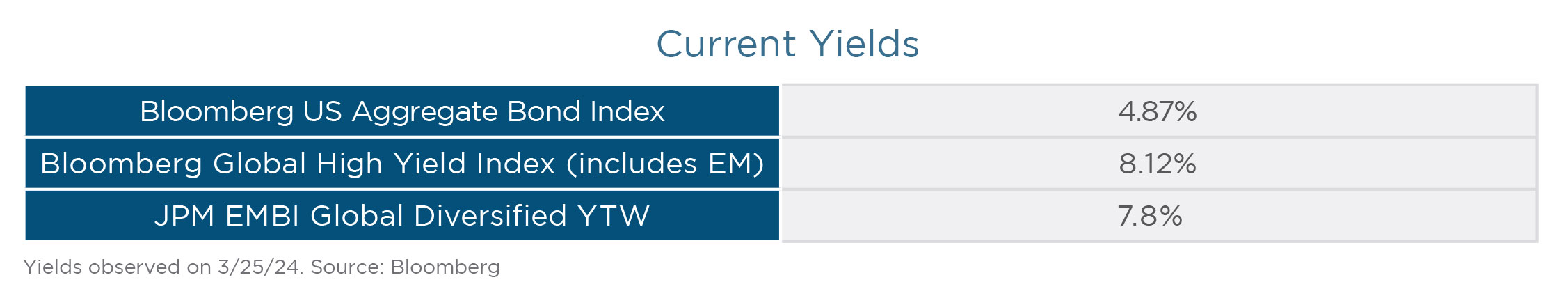

The Fed and other central banks on the global stage were compelled to counteract the decidedly non-transitory inflationary wave that had taken hold of the global economy. The Fed began aggressively hiking rates in March 2022 and hiked the policy rate a total of 11 times to bring the target Fed Funds upper bound to 5.5%, where we are today. Whether or not the Fed reacted too late or appropriately is now history. Instead, we turn our focus to what happened once the hiking cycle began. After almost 15 years of loose monetary policy, rate hikes began to accumulate, and fixed income investors rushed to the exits. This was most pronounced in lower quality/higher risk credit. High-yield bond outflows totaled $55 billion between 2022 and 2023. EM hard currency funds saw even larger outflows, and negative EM fund flows totaled a whopping $67 billion during that same period. Spreads widened, yields rose, and where once risks were underappreciated, the landscape became, at the very least, more appropriately priced. Unfortunately, as many fixed income funds underperformed, negative flows from both active and passive (ETF) sellers continued to dominate the market, and with few marginal buyers, yields continued to rise. Here’s where we stand now yield-wise:

Enhanced Yield and Return Potential:

Enhanced Yield and Return Potential:

Given the yields above, the differential is plain to see on a yield and carry basis alone. Global HY and EM credit typically offer higher spread and yields versus traditional core fixed income assets, which can, in turn, lead to better total returns. However, there’s more to this component than yield and carry – there is also the potential for significant capital appreciation rarely found in core investments.

As mentioned earlier, during the QE era, spreads had come to levels where investors were not compensated enough for the risks associated with HY and EM Credit. With the onslaught of negative flows over the last two years, some credits have been fundamentally mispriced due to technical reasons like outflows and heavy positioning. Some truly golden opportunities have emerged from the carnage of the last two years. However, like in core, not everything in EM and HY is a good investment. Proper due diligence is required.

While a rigorous investment process, strong security selection, and risk management are needed for all investments, they are especially necessary as you explore lower-rated credits. Diversification of investments is a must while managing risk, and the ability to invest in the Core+ universe gives investors a greater degree of freedom to diversify.

Diversification and Risk Management:

Truthfully, some core investors have difficulty admitting that they are often biased towards the familiar. One can hardly blame them; we all find comfort in what we know. However, staying too close to home can be a disservice to you and your investors. In the case of core, there tends to be a heavy domestic focus and a focus on IG credit. It’s narrow in scope and somewhat limiting – it’s a big world, and you risk missing a multitude of lucrative opportunities by ignoring international markets. Core markets also tend to be highly correlated. Core+ gives investors the ability to allocate into alternative streams of revenue and diversify into new geographies and asset classes like sovereign debt, thereby reducing both correlation to idiosyncratic US events and concentration in domestic IG markets.

Investing in Core+ offers a great deal of flexibility; as an investor, you can make an active decision on the amount of “plus” you want in your portfolio. It could be an underweight tactically or maxed out to a level dictated by your mandate (if such limitations exist). This flexibility is a valuable tool in managing your risk and actively managing your investments. That being said, experience and the knowledge that comes with that experience in the sometimes opaque and volatile EM and HY markets are invaluable assets in navigating these markets.

Why Now?

With nearly twenty years of global credit investing experience, we know that opportunities such as the current environment are rare. In the last two decades, we’ve only seen yields of this magnitude post the initial stages of Covid and the financial crisis. In truth, we may have missed the early stages of this opportunity, as yields in EM and HY are already off the peak levels we saw in late 2023.

Skeptics might argue that getting long EM and HY in the face of protracted outflows is a bit like catching a falling knife, and that is a fair argument. Still, it is important to consider where we are in the credit cycle and expectations for monetary policy in the near term. While we believed what markets had priced at the end of 2023 was far too bullish on the velocity and volume of rate cuts, we still believe that rates have peaked for this cycle and that the Fed will begin easing sometime in the second half of 2024.

Inflation has proven to be stickier than the market (and the Fed) would have liked, and as a result, a March or early 2024 cut is likely out of the question. However, by the second half of 2024, we believe labor markets will weaken, inflation will be at or very close to the Fed’s target, and the resiliency the economy has shown up until now will begin to show some cracks. In response, the Fed will deliver the first of several rate cuts by year-end.

While a slowing economy might not seem like a compelling argument to add risk, when rates begin to ease, historically, investor momentum eventually shifts away from safety and the search for yield manifests itself in positive flows often ahead of economic recovery. In fact, USHY flows have already begun to recover (EM continues to have outflows). It will pay dividends in the long term to be ahead of the reversal of flows and build up positions before they turn; it’s always better to ride the wave rather than chase it when the tide turns. As Warren Buffet famously said, “be greedy when others are fearful.”

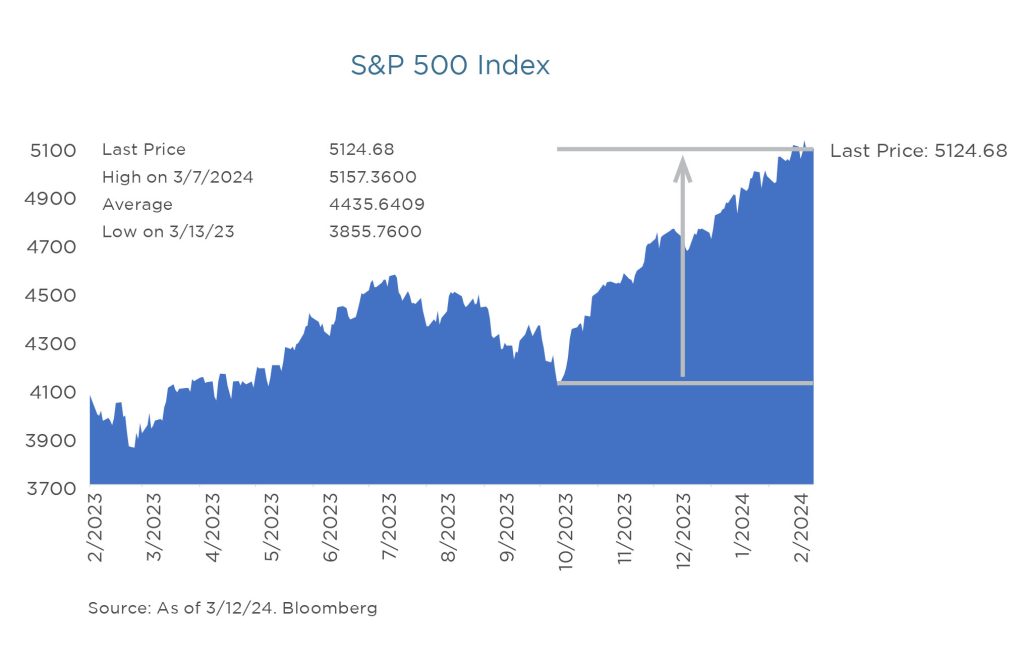

Ironically, there is far less to fear in Core+ versus equities. The Global HY Index is up around 12% from the low in October; during that same period, the S&P is up 24%. Equities have painted a far rosier picture than fixed income, making Core+ a more attractive and, we believe, a possibly safer investment choice. Consider it a choice: would you rather bet that equities hold or continue their outperformance or bet on Core+, which comes with ~6%+ income built-in and a potential medium- to near-term inflection point? If rates remain elevated in a “higher for longer scenario,” equities will underperform and give back most, if not all, of the outperformance. On the flip side, If the economy does truly slow down by the second half of 2024 and rates start falling due to weakness in labor and a deflationary environment, we suspect equities will again underperform as Core+ rallies with rates. We also believe that higher yielding credits with stronger than priced in balance sheets and credit metrics would be able to navigate a weaker economy and offer a much more attractive risk/reward profile. While there would likely be a degree of spread widening in the second scenario, as flows become more positive, the widening would be shortlived, and fixed income, particularly higher beta strategies like Core+, could experience an equity-like return profile as underappreciated and mispriced HY/EM credits compress with looser credit conditions and easier monetary policy.

Lastly, we note two key elements that we believe make the Global EM opportunity set particularly attractive at the moment:

Lastly, we note two key elements that we believe make the Global EM opportunity set particularly attractive at the moment:

1. EM policymakers were collectively more reactive and quicker to respond to global inflationary pressures than their DM counterparts.

2. US fiscal and monetary policy will weaken the USD which would be positive for foreign corporations and governments that have dollar debt load.

3. Nearshoring presents potential upside for Latin America and Western allies.

Several Latin American central banks (CBs), including Mexico and Brazil, and a handful of Eastern European CBs hiked rates months before the Fed. In previous cycles, EM central banks were far more reactive to the Fed, often to their detriment. In this cycle, emerging markets were well ahead of the curve and are in a much better position from a policy perspective. We expect that as the Fed begins to cut rates, EM CBs will aggressively begin cutting rates (some have already started), and while DM growth remains anemic/weak, EM growth will be relatively strong and net positive for EM credit.

We also expect US fiscal policy to continue on an expansionary trajectory in the near to medium term. Coupling US budget deficits and greater debt issuance with monetary policy easing, we expect to see a weaker USD as dollar supply increases. From a macro credit perspective, the key benefits of a weaker USD for non-US corporations and foreign governments are quite clear. Not only will foreign corporations have better export competitiveness, their dollar debt load will become less burdensome as their domestic currencies appreciate versus the weaker dollar. EM countries and corporations also tend to be commodity exporters and in commodity related industries, a weaker USD highly correlates to higher commodity prices directly benefiting sovereign and corporate revenues.

Lastly, another EM specific opportunity of note is the impact of nearshoring, particularly on Latin America. The U.S. Department of Commerce recently reported that Mexico is now the largest importer to the U.S. at $475.6BN (+4.6% yoy) vs. China at $427.2BN (-20% yoy). We expect this trend to continue and believe Western nations will place a greater reliance on neighbors and allies (“friendshoring”) in the near term. It is the most practical decision logistically, politically, and economically for the U.S. and the rest of the West to continue down this path. Ultimately, the upside potential for further growth and development in Latin America and Asia (ex-China, e.g., Indonesia, South Korea, Vietnam) is massive, and the credit opportunities offered in the near term require close attention.

Given these factors, we prefer an EM bias in Core+ weighting and construction in the medium term and expect EM to outperform USHY at a minimum. As mentioned earlier, security and sector selection will be the biggest challenge and differentiator in Core+ for the next two years, and experienced market participants will have an edge.

Edge or not, however, we expect Core+ in general will handily outperform Core Fixed in 2024 and could also outperform domestic equity in the near term.

Senior Portfolio Manager