From Dot-Com Boom to AI Revolution: Parallels and Predictions

February 7, 2024

The internet’s explosive emergence in the late 1990s mirrored the current excitement surrounding Artificial Intelligence (AI). Back then, tech giants like Netscape, Amazon, Yahoo, and Cisco soared on the promise of a connected future. Today, Nvidia, Meta, Alphabet, Microsoft, and Tesla are riding the wave of AI’s transformative potential. But just as the dot-com frenzy eventually gave way to broader economic integration, AI’s impact will extend far beyond its initial champions. Just like John Deere, Target, Home Depot and others leveraged the internet to reshape their industries, so too will established players across healthcare, logistics, retail, manufacturing and more harness AI to optimize operations and unlock new possibilities.

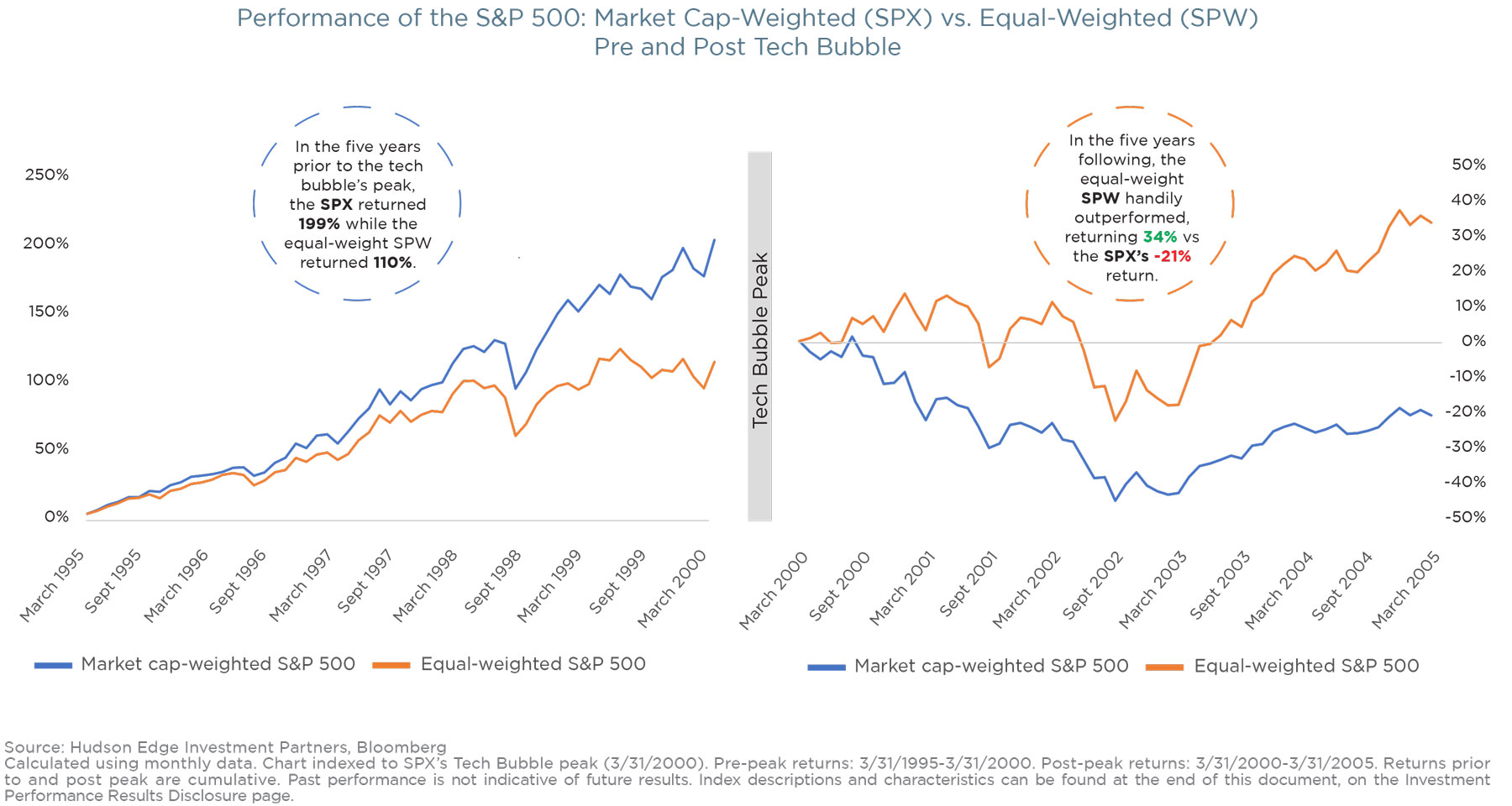

History offers valuable lessons. During the Dot-Com surge the S&P 500 (capitalization-weighted index) returned a cumulative 62.14% to the peak in March 2000, versus only 33.92% for the equal-weight version of the S&P over that same period 1. Following the tech bubble’s burst, the market witnessed a period of outperformance for equal-weighted portfolios compared to their market cap-weighted counterparts. From that S&P 500 peak on 3/24/00 through 9/12/2008, the equal-weighted version of the S&P 500 returned a cumulative 49.01% versus the cap-weighted index’s loss of 5.24% 2. This suggests that as AI adoption permeates the broader economy, a wider range of companies stand to benefit from the resulting productivity and profitability gains.

We are once again experiencing a run of outperformance for the cap-weighted S&P 500 over the equal-weighted index. The current dominance of the “Magnificent Seven” AI leaders resembles the dot-com era’s concentration, but as AI’s applications diversify, opportunities will emerge beyond these tech titans. Unlike the dot-com era’s focus on speculative promises, these AI leaders do boast substantial and often growing earnings, which could mean that these companies are ones that will endure to assist broader industry in the next stage of AI growth. This is where active management can shine, with its ability to identify and capitalize on these opportunities as the next stage of technological adoption occurs and begins providing substantial earnings and profitability gains.

Furthermore, the historical outperformance of Value 3 stocks following the dot-com bubble hints at a potential parallel with AI. Value companies, often overlooked during periods of hype, could see renewed interest as investors seek undervalued businesses poised to thrive in the AI-powered future.

While the initial excitement surrounding AI is reminiscent of the dot-com boom, the true story will unfold in the broader economic integration of this transformative technology. Markets have been promised many technologies over the years that would “change the world” over the past few decades, think Blockchain for Everything, virtual reality, and 3D Television, but AI is different and does bear the hallmarks of a technology with transformative staying power. Just as the internet reshaped entire industries, AI promises to do the same, creating opportunities for a wider range of companies beyond the current darlings. By actively seeking out these hidden gems and potentially undervalued Value plays, investors can position themselves to capture the full potential of the AI revolution, much like those who navigated the dot-com era beyond the initial frenzy.