All-stock M&A is back.

Companies are using elevated stock prices to buy high-quality small caps for cheap.

May 21, 2024

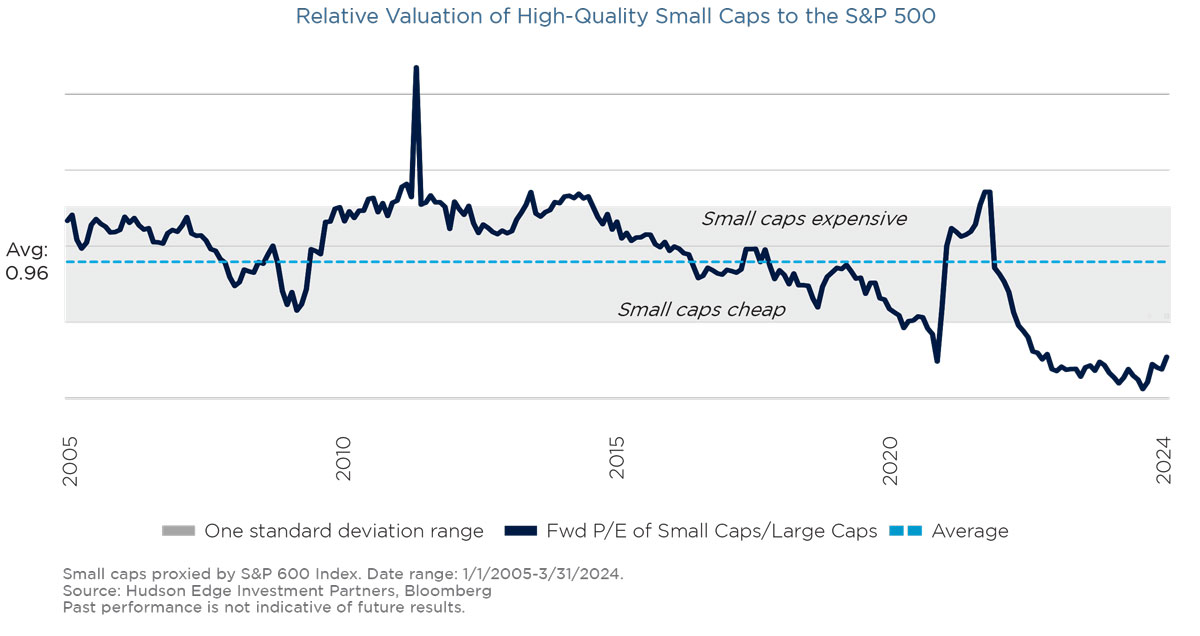

High-quality small caps are cheap, and the market is taking notice – in some form. While the driving market narrative has been AI- and tech growth-fueled, investors also like to point out that today’s leaders, the Mag 7, represent quality. This quality comes at a cost – sky-high valuations and concentration risk, and it can be easily avoided down-cap, where investors can find quality at a discount. Investors’ singular interest in pockets of the large cap market has held down valuations of high-quality small caps – and corporations have noticed.

M&A for US public companies is running hot this year, and it is occurring via an outsized number of all-stock transactions. Just the first three months of the year have seen 511 deals, versus 1,133 in all of 20231 and the long-term pre-COVID average2 of 860 per year. 2024 is set up for a spectacular full year, likely stronger than even 2022, the biggest year for M&A of this type in the last twenty, with 1,167 deals3.

M&A ran above long-term averages from 2021-2023, though, in our opinion, those deals felt more like companies seeking to buy growth versus today’s preference for quality companies. They were largely funded with cash, as companies accrued large cash balances to prepare for the COVID-19 pandemic that they ultimately didn’t need. Year to date4, all-stock acquisitions account for 22.5% of deals, an over 50% increase versus the LT pre-COVID average5. Companies are taking advantage of their heightened valuations – 82% of S&P 500 companies were within 15% of their 52-week highs on March 31 – to capitalize on deals down cap in the face of high interest rates, and buying quality at a discount to strengthen their portfolios.

We believe this run and style of M&A will continue. In the face of economic uncertainty, two things make sense: acquiring high-quality companies with reliable profitability profiles and doing so using elevated stock prices. Quality companies are always a good buy, but in a market focusing on quality rather than simply growth, these companies are now more alluring targets. Even in the face of a correction, and thus lower stock prices for companies to take advantage of, large cap cash is still at record levels, ready for M&A deployment – S&P 500 companies hold more than $3T in cash, exceeding the value of the entire Russell 2000. In this scenario, buying quality will make even more sense (and likely can be done even cheaper).

High-quality small caps, as measured by the S&P 600 Index (which excludes companies with negative earnings, unlike the Russell 2000), trade at valuations below five- and 10-year averages6. Small caps have been at the center of investors’ concerns over rising interest rates due to their greater reliance on loans and relatively weaker coverage ratios – but not all small caps are created equal, even if most have been discounted on these bases. Investors have largely looked past small caps in recent years, making M&A prices attractive. The result is high-quality companies with a discount too attractive to ignore.

Increased US regulatory scrutiny also favors small cap targets, as these less transformative deals do not pose the obstacles that large deals do – corporations are likely to favor smaller, bolt-on style acquisitions in this increasingly challenging regulatory environment.

In just the first four months of this year, Hudson Edge Small Cap Value has seen five portfolio companies acquired. This is a substantial and promising uptick from recent years. Interestingly, the targets were all in separate sectors, highlighting the importance of quality acquisitions today versus sector plays. The portfolio is comprised solely of high-quality securities trading at attractive valuations and is playing perfectly to current M&A dynamics. Broadly, expectations are for M&A to continue to be strong this year, and corporations’ preference for quality at a discount should allow corporate actions to be a substantial driver of investor returns. Companies are looking to take advantage of their stock prices to add quality to their portfolios as C-level uncertainty rises. We believe this uncertainty will benefit high-quality small caps.

We will continue to share our findings as we further develop any research around this topic. If you’d like to join the discussion, please don’t hesitate to reach out to us.