Earnings Growth to Rotate to US Small Cap

A main driver of market returns over the past two years is now set to shift.

February 5, 2025

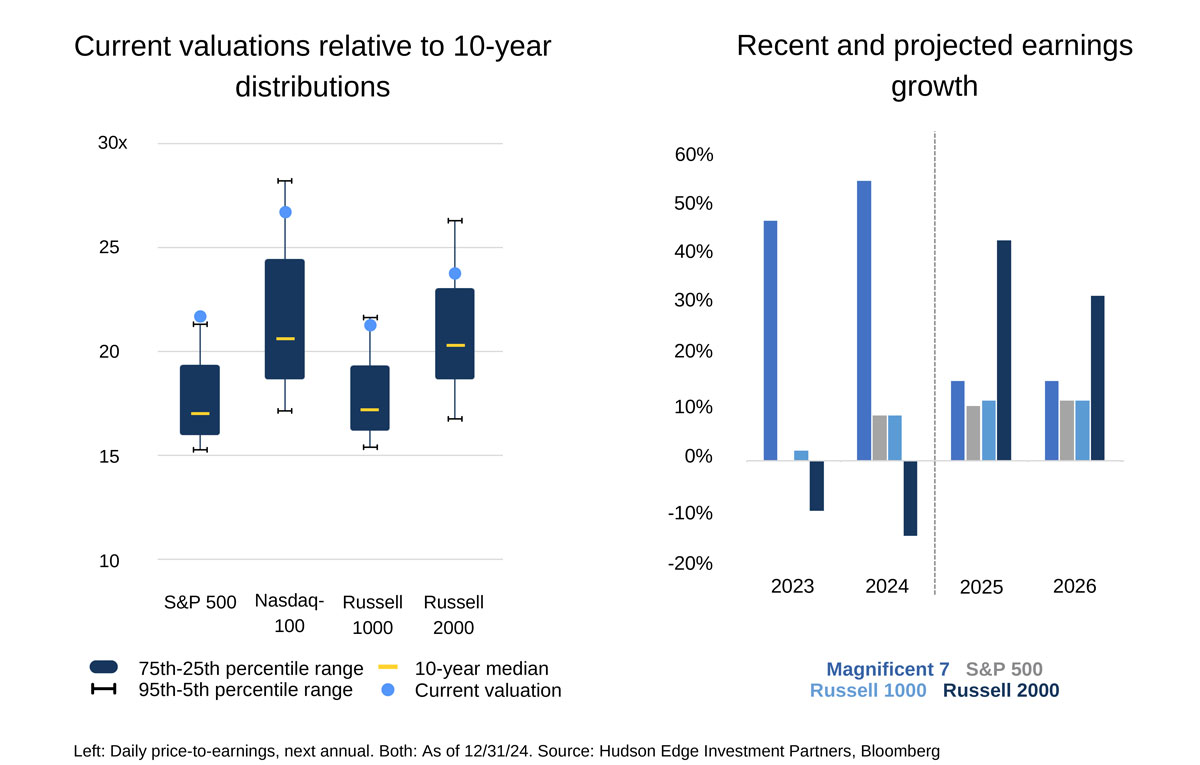

Over the past few years, we have seen US Equity valuations reach lofty levels, driven predominantly by large Information Technology companies known colloquially as the “Magnificent 7”. These companies have seen incredible price appreciation by keeping investor interest through their proximity to Artificial Intelligence, but also because they have been able to grow their earnings on a scale greater than any other cohort of companies. Their valuations were justified by their growth.

While that growth has accelerated over the last two years, investors now believe that it has reached a crescendo, and expectations are for a much more muted pace going forward. Small caps, after years of negative earnings growth, are projected to post 44% growth in 2025 and 33% in 2026, far eclipsing the Magnificent 7’s estimated 16% growth over both periods. But valuations don’t yet reflect this shift.

The strong run in price has created a valuation divergence. While US Large cap equities broadly look expensive relative to their range of the last 10 years, those of Small companies look more appealing. When we combine this lower valuation hurdle with the expectation for a sizable increase in earnings growth for Small companies over the next two years, we see what could be a key driver of market leadership change from Large US Tech to US Small cap.

The market narrative has been that Small caps have been left behind for a reason – but a major factor that justified the Mag 7’s meteoric rise is set to fizzle and shift to Small.

We will continue to share our findings as we further develop any research around this topic. If you’d like to join the discussion, please don’t hesitate to reach out to us.